Porter's Five Hybrid Forces Model is one of the fundamental tools for analyzing a firm's competitive environment and strategic management. In a world where the dynamics and changes in the market environment are gaining momentum, especially due to the rapid development of new technologies, this model provides a framework for understanding and navigating the world of market rivalry.

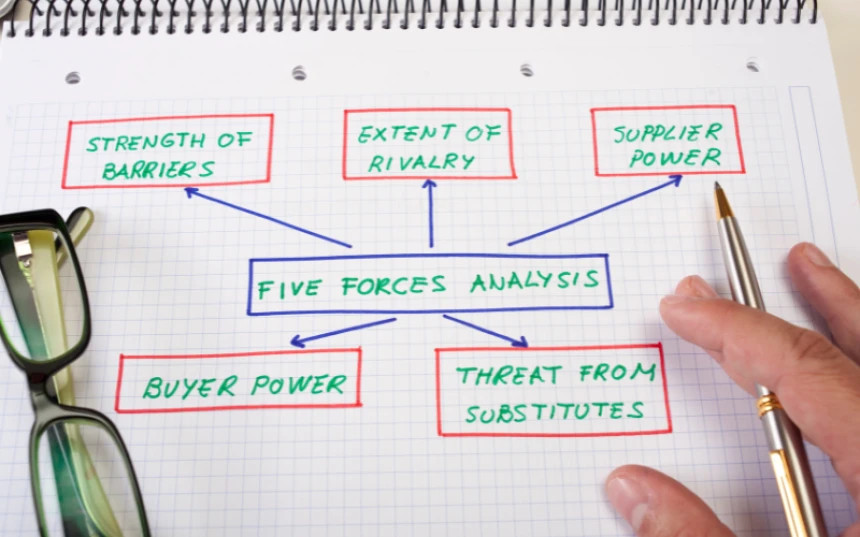

Porter's analysis (or 5F analysis) examines five key factors that have a direct or indirect impact on a company's competitiveness. This method is an alternative to the well-known SWOT analysis, which Porter considered too generic and incomplete. The main purpose of this model is to help anticipate opportunities and threats arising from the competitive environment and to adequately prepare business and marketing strategies.

Tip: Learn how to effectively use SWOT analysis to achieve your business goals.

Porter's Five Forces Analysis can be used to examine the situation in your business environment. It is worth updating it annually to check whether your market position remains strong or if it is declining.

Professor Michael Porter of Harvard Business School came up with the model. Since the model was first introduced to the public in 1979, it has developed into one of the most popular and respected tools for formulating business strategy. Porter observed that companies usually keep a close eye on their competitors. In his article for the Harvard Business Review, "How Competitive Forces Shape Strategy," he urged business leaders to look not only at the actions of their competitors, but also to examine the forces at work in the broader business environment.

The 5F analysis offers a method for evaluating the industry under study and its risks using five important factors (Five Forces, hence the name 5F). The aim is to predict the evolution of the competitive environment in the industry under study based on the estimated behaviour of the following market actors and factors and the risks they pose to the company:

The entry of new competitors into an industry usually brings a reduction in profitability for existing firms. A new firm in the market means increased production and therefore increased supply, which often leads to lower prices for products or services. In addition, there is also a reduction in market share, which further reduces the profits of existing firms. Two main factors hinder the entry of new firms into a given market: entry barriers and the potential reaction of existing firms to a new entrant.

As Porter writes in his book Competitive strategy: techniques for analyzing industries and competitors, there are many types of entry barriers, for example:

Any firm considering entering the sector must consider each of these barriers, and it is in the interest of existing firms to maintain these barriers or even create new ones. It is also essential to take into account the possible reactions of these established players, who may respond to new competitors with aggressive strategies such as price cuts, product innovation or increased advertising expenditure in order to maintain their market share and discourage new entrants. Porter also identifies six main sources of entry barriers in his book:

Powerful suppliers can set different terms and conditions, such as higher prices or delivery times, which can reduce the profitability of the industry. Factors that increase the power of suppliers include:

The bargaining power of buyers can be a major problem in certain circumstances. If buyers have a strong position, they may demand lower prices, higher quality, better service and other benefits, which can increase costs and reduce profits in the industry. The bargaining power of buyers is greater if:

Rivalry in the industry significantly affects profitability. Higher rivalry usually leads to lower profits because firms have to invest more in acquiring customers, which increases their costs. This may include lowering prices, investing more in advertising or offering extra services to customers. It is important for a business to be aware of its position in the market compared to its competitors and to develop a strategy to deal effectively with rivalry. The nature of competition can vary across industries based on factors such as:

Tip: Learn about the blue ocean strategy and outcompete your competitors once and for all.

Substitutes are products or services whose consumption provides a benefit to the customer. Customers can choose the ones they need based on preference. Substitutes are important for businesses because they affect price ceilings in the market. If the prices of a product are too high, customers can easily switch to a more affordable substitute product.

Defences against substitutes can include advertising, product differentiation and, above all, branding, as customers often prefer well-known brands to cheaper and unfamiliar ones. Cars, watches, smartphones and clothing are examples of areas where brand plays a significant role. Competitive pressure from substitutes is influenced by three factors:

The model is essentially based on a microeconomic framework - an analysis of the market, firm and consumer behaviour. Porter's model unpacks competitive pressures and rivalry in the marketplace that arise from the interaction of underlying forces (such as the aforementioned competitors, suppliers, customers and substitutes). They thus define the profit potential of a given industry.

What can you gain from the five forces of competition analysis?

Although Porter's model is well respected and widely used in strategic management, like any analytical tool it has its strengths and weaknesses. It is important for managers and analysts to be aware of these strengths and weaknesses so that they can then use the tool effectively and to its full potential. We will now look at some of the pros and cons of Porter's Five Forces Analysis to better understand how this model can both support and limit strategic planning in your firm.

1) Pluses:

2) Cons:

As an example, consider Apple's smartphones, which were discussed in more detail in Miro's article. This example shows how Porter's analysis can be used to identify and evaluate the different market forces that affect Apple's position and competitiveness in the industry.

With the launch of the iPhone, Apple gained a dominant position, however, over time the market has become highly competitive due to the arrival of new players.

Designing and manufacturing a smartphone is not easy, but the knowledge and infrastructure already exists, especially in China. In recent years, new brands such as Oppo and Realme have emerged in the market and started to build their position.

Apple and other electronics manufacturers depend on specific materials such as rare earth minerals (such as neodymium and dysprosium, which are used in magnets for headphones and speakers). Even so, Apple has some leverage due to its volume and buying power and is not losing out.

Telecom providers are the main buyers of smartphones and have an impact on sales. However, Apple is not dependent on these partnerships due to its stores and strong brand.

While there are many quality smartphones on the market, the combination of Apple's brand, user interface, and overall user experience keep the threat of iPhone substitution low. Apple's user interface is considered significantly more intuitive than Android's, leading many users to imagine not switching to another operating system. A significant proportion of Apple customers are also loyal and do not think about switching brands because using Apple products has become part of their identity.

Porter's analysis reveals that Apple stands in a strong but highly competitive position in the smartphone market. Despite high competition and a moderate threat of new competitors, Apple maintains a stable position due to its brand, innovation and customer loyalty. The medium bargaining power of suppliers and buyers shows that Apple has some control over its supply chain and sales channels, but still needs to be vigilant against market pressures.

The low threat of substitution then indicates that Apple's customers have a strong preference for the brand's products, making it difficult for competitors to acquire them. Overall, these factors indicate that Apple should continue to differentiate its products and strengthen its brand while focusing on innovation and efficiency improvements to maintain its competitiveness and profitability in a challenging market.

As you may have learned from the article, Porter's Five Forces Model is a useful tool for analyzing the competitive environment and strategic marketing planning in a company. In a dynamic market environment, it provides a framework for understanding market rivalry and competitive pressures. Thus, Porter's analysis enables firms to anticipate opportunities and threats and plan business and marketing strategies accordingly.

If you are more interested in the topic of strategic marketing planning and analysis, Algotech can help you by implementing enterprise systems from which you can easily extract the data you need to manage your company. We also recommend that you read the educational articles on our blog.

Copyright © 2026 - Algotech a.s., all rights reserved

| Personal data processing |

Terms and conditions